Maldives Parliament Proposes Significant Tax Increases: A Closer Look

In a recent move that has raised eyebrows in the Maldives' tourism and aviation sectors, the Parliament is contemplating substantial increases in several key taxes. This proposal, introduced by government member Musthafa Ibrahim, aims to address fiscal challenges and bolster foreign currency income through strategic revisions to the current taxation framework.

Doubling the Green Tax

One of the most significant changes proposed is to double the Green Tax from the current $6 to $12 per night for tourists. This increase is aimed at generating additional revenue for the government, with estimates suggesting that the revised Green Tax could contribute around 963.6 million Rufiyaa to state coffers. The Green Tax, initially introduced to promote sustainable tourism, has become an essential source of income for the country, and this proposed increase underscores the government's focus on environmental conservation as well as fiscal stability.

Revisions to the Goods and Services Tax (TGST)

In addition to the Green Tax, Musthafa Ibrahim has submitted a revision to the existing Goods and Services Tax (GST) law, proposing an increase from the current 16% to 17% beginning June 2025. This modest adjustment is projected to generate an additional 201.9 million Rufiyaa in tax revenue, contributing significantly to the country's efforts to manage its fiscal debt and maintain a healthy flow of foreign currency.

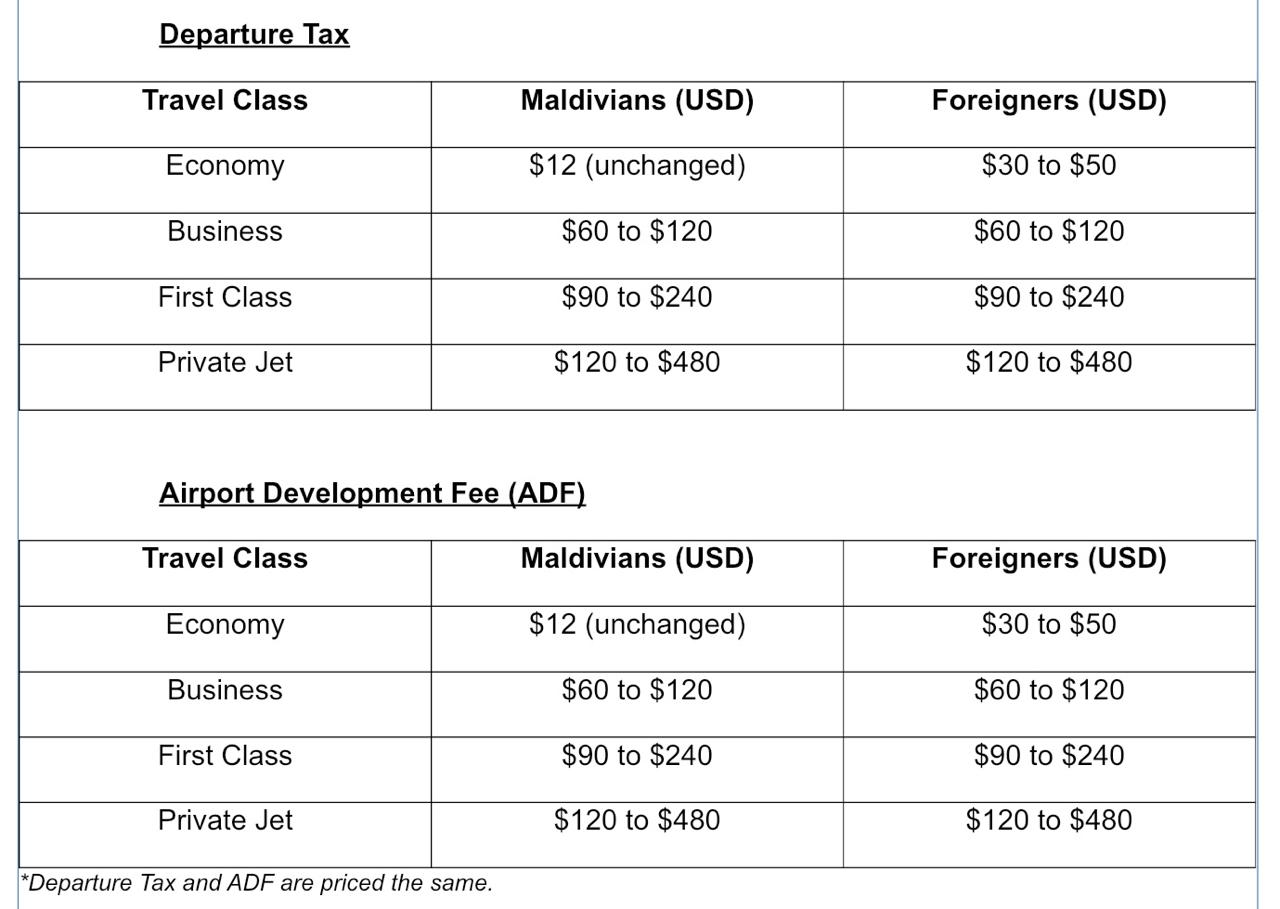

Changes to Airport Taxes

The proposals don’t stop there. The Parliament is also considering adjustments to the Airport Departure Tax and the Airport Development Fee. It is estimated that these changes could generate approximately 796.5 million Rufiyaa from the Departure Tax and 809.8 million Rufiyaa from the Airport Development Fee.

Implications for the Tourism Sector

While the government argues that these tax increases are necessary to improve fiscal health and sustain public services, the implications for tourists and the broader tourism industry are significant. The Maldives is renowned for its pristine beaches and luxury resorts, and while the natural beauty draws travelers from around the globe, consistent increases in taxes may deter some visitors, particularly if the costs become prohibitive.

Conclusion

As the Maldives navigates the dual challenges of economic recovery and fiscal responsibility, the proposed tax increases could play a pivotal role in shaping the future of tourism in the country. Stakeholders in the tourism and aviation sectors will need to remain vigilant, as these changes could impact pricing strategies, tourist inflow, and the overall competitiveness of the nation as a prime travel destination.

The upcoming discussions in Parliament will be crucial in determining the trajectory of these proposed amendments. As the situation unfolds, the Maldivian government must balance the necessity for increased revenue with the potential effects on one of the nation’s most critical sectors—tourism.